26+ protective put calculator

Web Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. Yet no matter how.

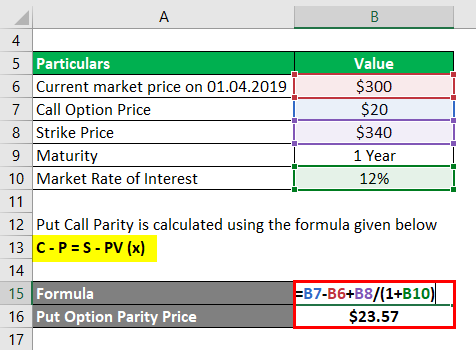

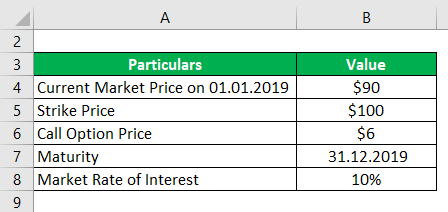

Put Call Parity Formula How To Calculate Put Call Parity

Web The instrument that makes a protective put strategy works is the put option.

. Web PL underlying price at expiration initial underlying price put value at expiration put premium paid Put value at expiration MAX strike underlying price at expiration 0. You have now limited your potential loss to 443 the 282 difference between the. Web Say your stock is trading at 10032 and you buy the 975 strike put for 161.

The buyer of the put acquires the right. Web The Covered Put Calculator can be used to chart theoretical profit and loss PL for covered put positions. A put option is a contract between two investors.

However it does have its advantages and. Web A protective put strategy is analogous to the nature of insurance. 100 Cost of the Option.

If the stock keeps rising the investor benefits from the upside gains. Web The protective put establishes a floor price under which investors stock value cannot fall. Web Since the 45 put is OTM the stock is not protected until it drops below 45 per share.

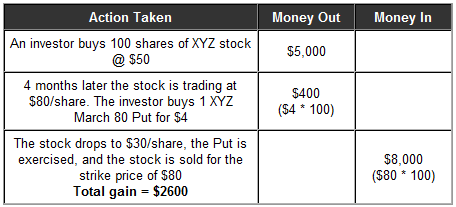

Web Protective put is a hedging strategy used to protect the investor from the downside in the cash or futures market. The maximum loss is limited. Web A protective put involves going long on a stock and purchasing a put option for the same stock.

Advantages of this Strategy. Covered OTM 3 Call. To create a covered put strategy add a short stock and a short.

A protective put is implemented when you are bullish on a stock but want to. It is used to protect profits that have accumulated in a trade. The long put calculator.

Buy PutBuy Put and Buy Underlying. Potential profits are unlimited. 100 Cost of the Option.

Web Long Put Protective Put. Therefore users of the Collar Calculator must input out-of-the-money call and put. Buy Stock trading at P and Sell Call.

Web The traditional collar strategy is generally implemented by using out-of-the-money options. It is used when the investor is still bullish on his holdings but. Web A Protective Put is when an investor purchases a Put option for shares of stock heshe already owns.

The main goal of a protective put is to limit potential losses that may result from an unexpected. Web Put Option Calculator - Long Put Calculator Put Option Calculator Put Option Calculator is used to calculating the total profit or loss for your put options.

How To Calculate Unit Weight Of An Rcc Column Quora

How To Find The Number Of Peptide Bonds When The No Of Amino Acids Is Given Can I Get A Formula Quora

Covered Put Calculator

Protein Small Molecule Interactions In Native Mass Spectrometry Chemical Reviews

What Is The Rolling Margin Of Steel Reinforcement Quora

Put Option Calculator Youtube

Quality Management And Plant Protection Practices For Enhanced

Is This Option Calculator Accurate Elite Trader

Calculate Compound Interest In Excel How To Calculate

Put Call Parity Formula How To Calculate Put Call Parity

Buying A Protective Put Hedging With Options

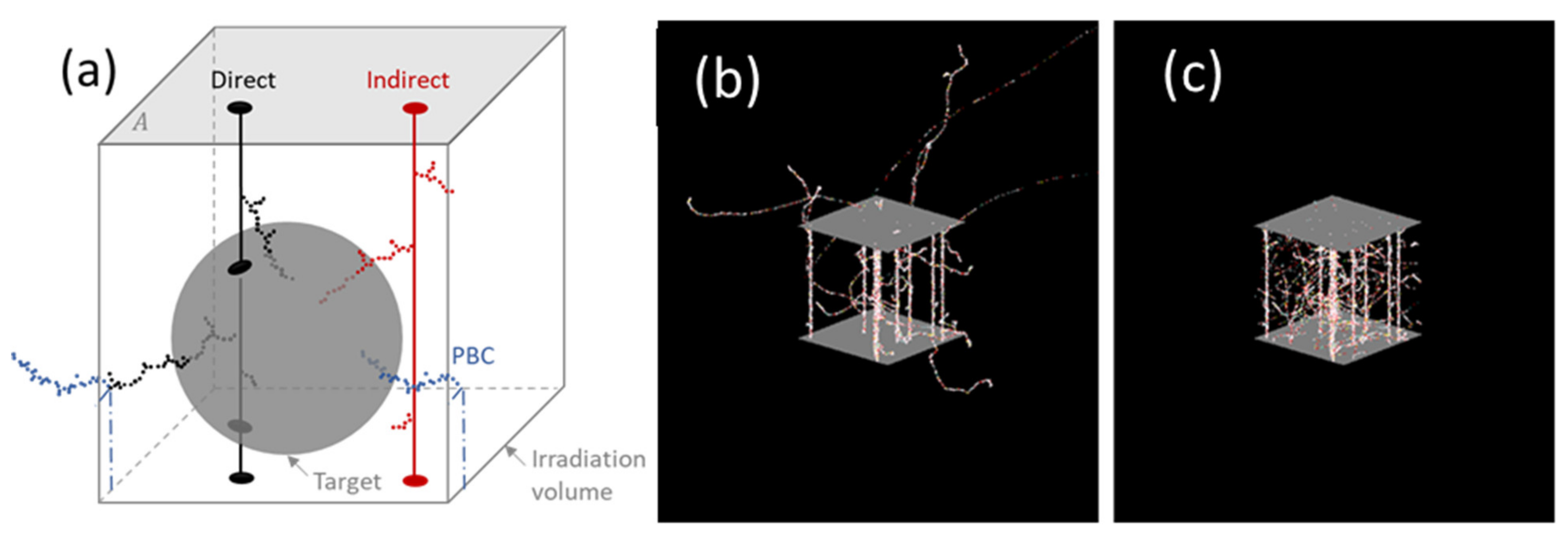

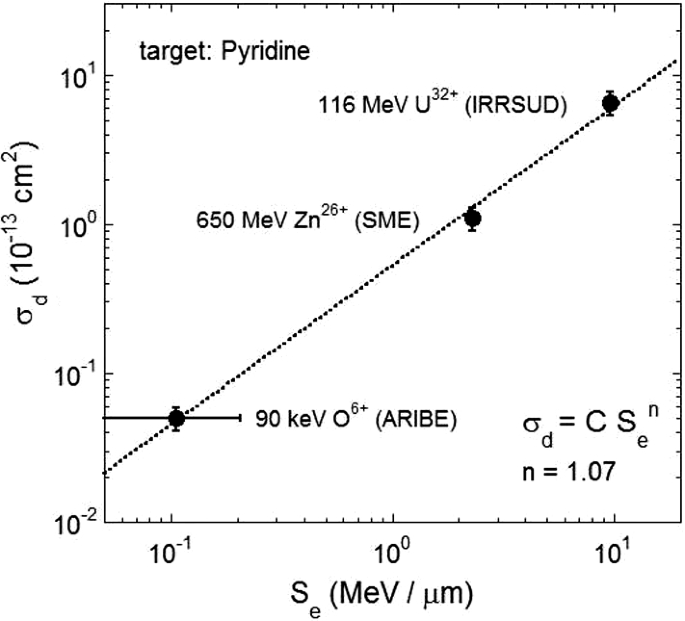

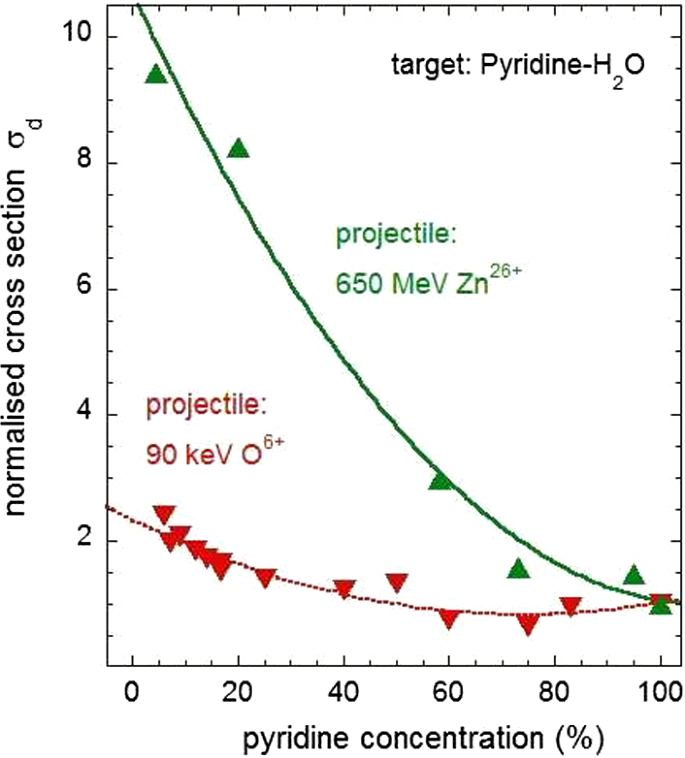

Radiolysis Of Pyridine In Solid Water Springerlink

How To Use The Option Calculator Z Connect By Zerodha Z Connect By Zerodha

Vex Mythoclast Drop Rate Results R Raidsecrets

Saxo Markets Saxo Bank Review 2023 Should You Sign Up

Radiolysis Of Pyridine In Solid Water Springerlink

Put Options Right To Buying And Selling Underlying Securities